How to Buy Solana Introduction – Why I Decided to Buy

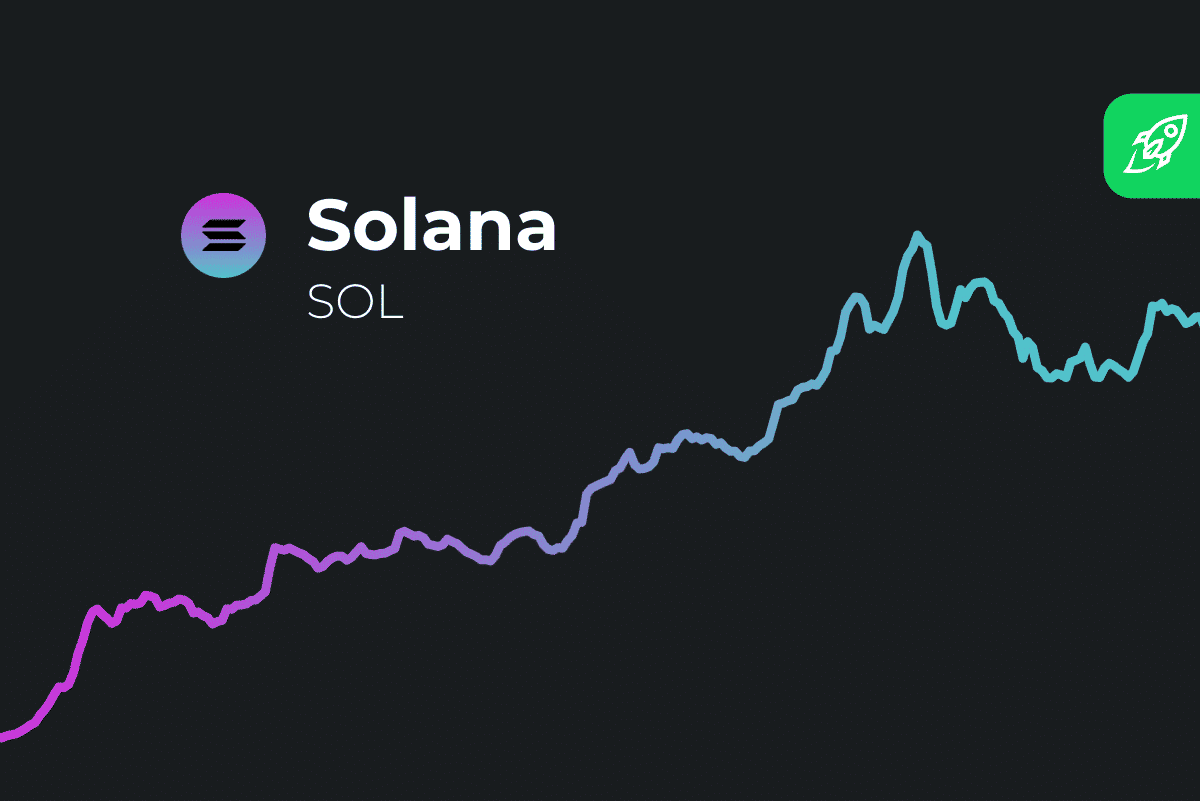

When I first began my journey into the world of cryptocurrencies, I felt a bit overwhelmed by the sheer volume of options out there. As most newcomers do, I started by looking into the big names like Bitcoin (BTC) and Ethereum (ETH). However, there was a cryptocurrency that kept coming up in my research—Solana (SOL). I’d heard so much about it, especially how it was becoming one of the most talked-about cryptocurrencies. It wasn’t just about its price being more affordable compared to Ethereum or Bitcoin, but also about the technology behind Solana that seemed to set it apart.

Why I Chose to Invest in Solana

I’ve always been intrigued by new technologies, especially those that challenge the status quo. Solana’s Proof of History (PoH) consensus mechanism caught my attention. Unlike Bitcoin’s proof of work or Ethereum’s proof of stake, PoH is an entirely new approach that uses time to validate transactions. I found this innovation particularly interesting because it addresses one of the major issues plaguing Bitcoin and Ethereum—scalability. Solana is capable of processing thousands of transactions per second (TPS), making it far more efficient than other blockchain networks.

Additionally, the fees associated with Solana transactions are significantly lower than that of Ethereum or Bitcoin. Given that transaction costs can add up quickly, especially when you’re trading or making small payments, this was a huge plus for me.

Another reason I decided to buy Solana was its price. When I started looking into Solana, it was trading at around $40, making it much more accessible for someone just getting started in crypto, like myself. I saw it as an opportunity to buy into a project with strong potential, without paying a high premium.

So, how did I go about buying Solana? Here’s a breakdown of the process that I followed, and I’m here to share it with you. From choosing the right exchange to storing my Solana securely, I’ll walk you through the steps that I took. But before we dive into that, let’s first take a look at what Solana is and why it stands out in the crypto world.

How to Buy Solana: What is Solana?

Solana is a decentralized blockchain platform designed to provide high throughput and low-cost transactions. The network was launched in 2020 and has rapidly gained traction among developers and investors. Its key feature is its Proof of History (PoH) mechanism, which improves scalability and speed without sacrificing decentralization or security.

When I first heard about Solana, I thought it was just another altcoin. But after diving deeper into its technology, I realized it had something special. Solana isn’t just trying to be another blockchain; it’s trying to redefine how blockchain technology works. Here’s why:

- Proof of History (PoH): As mentioned, this consensus mechanism is one of the main reasons why Solana is faster than other blockchain networks. It creates a cryptographic timestamp that helps validate transactions, making the process much quicker and more efficient. This is a huge leap forward compared to the slower processes of Proof of Work (PoW) or Proof of Stake (PoS).

- Speed and Scalability: Solana is capable of processing up to 65,000 transactions per second (TPS), a significant improvement over Bitcoin’s 7 TPS or Ethereum’s 15 TPS. This scalability is what makes Solana appealing not only to developers building decentralized applications (dApps), but also to businesses looking for low-cost, high-speed transactions.

- Low Fees: Unlike Ethereum, where fees can often exceed $20 for simple transactions, Solana’s fees are incredibly low—often just a few cents. This made Solana especially attractive to me as someone who wanted to buy into the crypto space without worrying about transaction costs eating into my profits.

So, why should you care about Solana? If you’re someone who believes in the potential of blockchain technology and its ability to reshape industries, Solana is worth paying attention to. Whether you’re looking to buy Solana for investment purposes or to use it for building decentralized applications, Solana provides a robust and scalable solution.

How to Buy Solana: My Step-by-Step Guide

Now that I’ve shared a bit about why I decided to buy Solana, let’s move on to the step-by-step guide for purchasing it. You might be wondering, “How do I buy Solana?” Well, I’m here to break it down for you. Whether you’re a beginner or someone with experience in crypto, I’ll make sure you understand every step clearly.

Step 1: Choosing the Right Exchange

The first thing I had to do was choose an exchange that supports Solana. There are several platforms that allow you to buy SOL, but it’s important to pick one that suits your needs. I personally chose Coinbase, as it’s widely considered one of the easiest platforms to use, especially for beginners. However, if you’re looking for other options, here are some great exchanges I’ve used and recommend:

| Exchange | Supported Pairs | Fees | Features |

|---|---|---|---|

| Coinbase | SOL/USD, SOL/USDT | 1.49% per trade | User-friendly, fiat support |

| Kraken | SOL/USD, SOL/EUR | 0.16% – 0.26% | Advanced features, low fees |

| Binance | SOL/USDT, SOL/BTC | 0.10% per trade | Low fees, diverse coins |

| KuCoin | SOL/USDT, SOL/BTC | 0.10% per trade | Fast execution, a wide variety of altcoins |

Coinbase was my platform of choice, mainly because of the ease of use and the ability to directly fund my account via a bank transfer. This made the process smooth and hassle-free. However, depending on your location and preferences, you might find Kraken or Binance better suited to your needs.

Step 2: Funding Your Account

Once I selected Coinbase, the next step was to fund my account. You can fund your account in a few ways:

- Bank Transfer: The most straightforward method, which usually comes with low fees.

- Debit/Credit Card: An easy option but often comes with higher fees.

- Cryptocurrency Transfer: If you already own crypto, you can transfer it directly to your Coinbase account.

I opted for bank transfer since it had the lowest fees. It took a couple of days for the funds to clear, but once they did, I was ready to buy Solana.

Step 3: Placing Your Order

Once my account was funded, I was ready to buy Solana. I decided to purchase $50 worth of SOL. To do this, I simply searched for Solana (SOL) on the platform, entered the amount I wanted to purchase, and placed my market order. A market order allows you to buy at the current market price.

If you prefer more control, you can choose a limit order, where you specify the price you want to pay for Solana. However, I went with a market order because I was eager to make my purchase right away, and it was fast and straightforward.

Step 4: Storing Your Solana

After buying Solana, it’s crucial to store it safely. I transferred my SOL to a hardware wallet for long-term storage. How to buy Solana securely and store it offline is important for ensuring your investment is safe from hacking or theft.

I use the Ledger Nano X, which is one of the most secure hardware wallets on the market. It allows me to store my Solana offline, making it less susceptible to hacking attempts.

FAQ: How to Buy Solana (SOL)

1. What is Solana (SOL) and why should I consider buying it?

Solana (SOL) is a high-performance blockchain that offers fast, scalable transactions. If you’re looking into how to buy Solana, it could be a good investment because of its low fees and transaction speed.

If you’re looking for a cryptocurrency with fast transaction speeds, low fees, and a growing ecosystem, Solana could be a great investment choice.

2. How do I buy Solana (SOL)?

To buy Solana (SOL), you need to use a cryptocurrency exchange. Here’s a step-by-step guide to purchasing SOL:

- Choose a cryptocurrency exchange: Popular exchanges like Coinbase, Kraken, Binance, and KuCoin support SOL. Choose an exchange that is easy to use and has low fees.

- Create an account: Sign up for an account on your chosen exchange, providing necessary details like email and identification.

- Fund your account: You can deposit fiat money (USD, EUR, etc.) via bank transfer, credit card, or debit card. Some exchanges also allow you to fund with other cryptocurrencies.

- Place your order: Once your account is funded, search for Solana (SOL) and decide how much you want to buy. You can place a market order (buying at the current price) or a limit order (buying at a price you set).

- Secure your SOL: After your purchase, it’s important to store your SOL securely. You can either use the exchange’s wallet (for short-term storage) or transfer your tokens to a hardware wallet for long-term storage.

3. What are the fees for buying Solana (SOL)?

The fees for purchasing Solana (SOL) depend on the exchange you use. Generally, exchanges charge a trading fee, which can range from 0.1% to 1.5% per transaction. Additionally, there might be fees for depositing or withdrawing funds depending on the payment method.

It’s important to check the fees on the exchange before you make a purchase to ensure you’re getting the best deal.

4. Can I buy Solana (SOL) with a credit card?

Yes, many cryptocurrency exchanges, such as Coinbase and Crypto.com, allow you to buy Solana (SOL) with a credit card. However, using a credit card often comes with higher fees, and some exchanges treat credit card transactions as cash advances, which can lead to additional interest charges and fees from your card issuer.

If you’re planning to use a credit card, be sure to factor in those extra costs. I personally recommend using a bank transfer or debit card for lower fees.

5. Is Solana a good investment?

While Solana has experienced significant growth, like any cryptocurrency, it comes with risks. The price of Solana can be volatile, and investing in any cryptocurrency should only be done with money you can afford to lose.

That said, Solana’s technology and its ability to process thousands of transactions per second at low fees make it a compelling project with long-term potential. If you’re looking for a blockchain with a promising future, Solana is definitely worth considering. Just remember to do your own research and understand the risks involved.

6. Where should I store my Solana (SOL) after buying it?

After purchasing Solana (SOL), it’s crucial to store it securely. There are a few options:

- Exchange Wallet: The simplest option is to leave your SOL in the exchange wallet where you bought it. However, this can be risky as exchanges can be hacked.

- Software Wallet: If you prefer easier access to your SOL, you can store it in a software wallet, such as Phantom or Sollet, which are specifically designed for Solana.

- Hardware Wallet: For the highest level of security, I recommend using a hardware wallet like Ledger or Trezor. These are offline wallets that store your private keys securely, making it much harder for hackers to access your funds.

7. Can I stake my Solana (SOL)?

Yes, Solana offers the ability to stake your SOL tokens and earn rewards. Staking involves locking up your tokens to support the network and earn a passive income. The process is simple:

- Choose a staking platform or validator (many exchanges like Coinbase and Kraken allow staking).

- Delegate your tokens: When you stake SOL, you delegate your tokens to a validator who helps secure the network.

- Earn rewards: You will receive staking rewards, usually paid in SOL, which can range from 5% to 7% APY depending on the validator and network conditions.

Staking is a great way to earn passive income from your investment in Solana.

8. What are the risks of buying Solana (SOL)?

Like all investments, buying Solana (SOL) carries certain risks, including:

- Price volatility: The price of Solana can be highly volatile, and there’s no guarantee it will continue to rise.

- Regulatory risk: The regulatory environment around cryptocurrencies is still evolving, and future regulations could impact the price and use of SOL.

- Technological risks: While Solana’s technology is groundbreaking, it’s still a relatively new platform. Issues like network outages or vulnerabilities in its code could affect the platform’s long-term success.

It’s important to understand these risks and only invest what you’re willing to lose.

9. How do I sell Solana (SOL)?

Selling Solana (SOL) is similar to buying it. Here’s what you need to do:

- Choose a crypto exchange where you can sell your SOL (most exchanges support SOL).

- Transfer your SOL from your wallet to the exchange, if it’s not already there.

- Place a sell order: You can sell SOL for fiat currency (USD, EUR, etc.) or other cryptocurrencies like Bitcoin or Ethereum.

- Withdraw your funds: Once your SOL is sold, you can withdraw the funds to your bank account or keep them in your exchange wallet.

10. Can I use Solana (SOL) for anything other than investment?

Yes! While Solana is often bought and sold for investment purposes, you can also use it in several other ways:

- Transaction fees: SOL is used to pay for transaction fees on the Solana network.

- Decentralized Finance (DeFi): Use SOL for lending, borrowing, or trading on decentralized exchanges (DEXs).

- NFTs: You can buy, sell, and trade NFTs on Solana-based marketplaces.

- Staking: As mentioned earlier, you can stake SOL tokens to earn passive income.

Conclusion: How to Buy Solana (SOL)

Now you know how to buy Solana and the reasons why it’s an attractive cryptocurrency option. With its innovative technology, fast transactions, and low fees, Solana is one of the most exciting blockchains in the crypto world today. Whether you’re a beginner or an experienced investor, buying Solana could be a smart addition to your portfolio.