Cryptocurrency has become a global phenomenon, revolutionizing the way we think about money, finance, and technology.

Whether you’re a seasoned investor or a curious newcomer, this guide will walk you through everything you need to know about cryptocurrencies, from their history and architecture to their economic impact and future potential.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that operates independently of a central authority, such as a government or bank. It uses cryptographic techniques to secure transactions, control the creation of new units, and verify the transfer of funds. Unlike traditional currencies, cryptocurrencies are decentralized, meaning they are not controlled by any single entity.

The first and most well-known cryptocurrency is Bitcoin, which was introduced in 2009 by an anonymous person or group known as Satoshi Nakamoto. Since then, thousands of other cryptocurrencies, often referred to as “altcoins,” have been created, each with its own unique features and use cases.

The History

Early Beginnings

The concept of digital cash dates back to the 1980s, with American cryptographer David Chaum introducing the idea of “ecash” in 1983. This was followed by the implementation of Digicash in 1995, an early form of cryptographic electronic payments.

In 1996, the National Security Agency (NSA) published a paper titled How to Make a Mint: The Cryptography of Anonymous Electronic Cash, which outlined a system for creating a decentralized digital currency.

The Birth of Bitcoin

In 2008, the world was introduced to Bitcoin, a decentralized cryptocurrency that used a proof-of-work system to validate transactions. Bitcoin’s whitepaper, authored by Satoshi Nakamoto, outlined a system that would allow users to transfer value without the need for intermediaries.

Since then, the cryptocurrency landscape has evolved rapidly, with thousands of new coins entering the market. As of 2023, there are over 25,000 cryptocurrencies, with many achieving market capitalizations exceeding $1 billion.

Key Milestones

- 2011: Litecoin, a Bitcoin alternative, is launched, using a different hashing algorithm (scrypt) instead of SHA-256.

- 2015: Ethereum is introduced, bringing smart contracts to the cryptocurrency world.

- 2021: El Salvador becomes the first country to adopt Bitcoin as legal tender.

- 2022: Ethereum transitions from proof-of-work to proof-of-stake, significantly reducing its energy consumption.

How Cryptocurrencies Work

Cryptocurrencies operate on a technology called blockchain, a decentralized ledger that records all transactions across a network of computers. Here’s a breakdown of how they work:

Blockchain Technology

A blockchain is a chain of blocks, each containing a list of transactions. Once a block is filled with transactions, it is added to the chain, creating an immutable record of all transactions. This system ensures transparency, security, and immutability.

Proof-of-Work vs. Proof-of-Stake

- Proof-of-Work (PoW): Bitcoin uses PoW, where miners compete to solve complex mathematical problems to validate transactions. The first miner to solve the problem is rewarded with newly created bitcoins.

- Proof-of-Stake (PoS): Ethereum transitioned to PoS, where validators are chosen based on the number of coins they hold. This system is more energy-efficient and reduces the computational power required.

Mining and Nodes

- Mining: Miners use powerful computers to solve complex algorithms, validating transactions and adding them to the blockchain.

- Nodes: Nodes are computers that maintain a copy of the blockchain and help validate transactions. They play a crucial role in maintaining the network’s integrity.

Types of Cryptocurrencies

Bitcoin (BTC)

As the first and most well-known cryptocurrency, bitcoin was designed as a decentralized digital currency, allowing users to transfer value without intermediaries.

Altcoins

Altcoins are alternative cryptocurrencies that emerged after Bitcoin. Some popular examples include:

- Ethereum (ETH): Known for its smart contract functionality, Ethereum allows developers to build decentralized applications (dApps).

- Litecoin (LTC): Often referred to as “digital silver,” Litecoin aims to process transactions faster than Bitcoin.

- Ripple (XRP): Designed for cross-border payments, Ripple focuses on speed and low transaction costs.

Stablecoins

Stablecoins are cryptocurrencies pegged to a stable asset, such as the US dollar. Examples include:

- Tether (USDT): Pegged to the US dollar, Tether is widely used for trading and remittances.

- USD Coin (USDC): Another stablecoin, USDC is known for its transparency and regulatory compliance.

Memecoins

Memecoins are cryptocurrencies inspired by internet memes. The most famous example is:

- Dogecoin (DOGE): Created as a joke, Dogecoin gained popularity and is now used for tipping and donations.

The Role of Blockchain Technology

Blockchain, the backbone, provides a secure and transparent way to record transactions. Here’s how it works:

Decentralization

Blockchain operates on a decentralized network, meaning no single entity controls the data. This eliminates the risk of censorship or manipulation.

Security

Cryptography is used to secure transactions, ensuring that only the owner can spend it. This makes blockchain virtually immune to fraud or hacking.

Transparency

All transactions on a blockchain are publicly visible, providing transparency and accountability. However, the identities of users are often pseudonymous, protecting their privacy.

Economic and Social Impact of Cryptocurrencies

Economic Impact

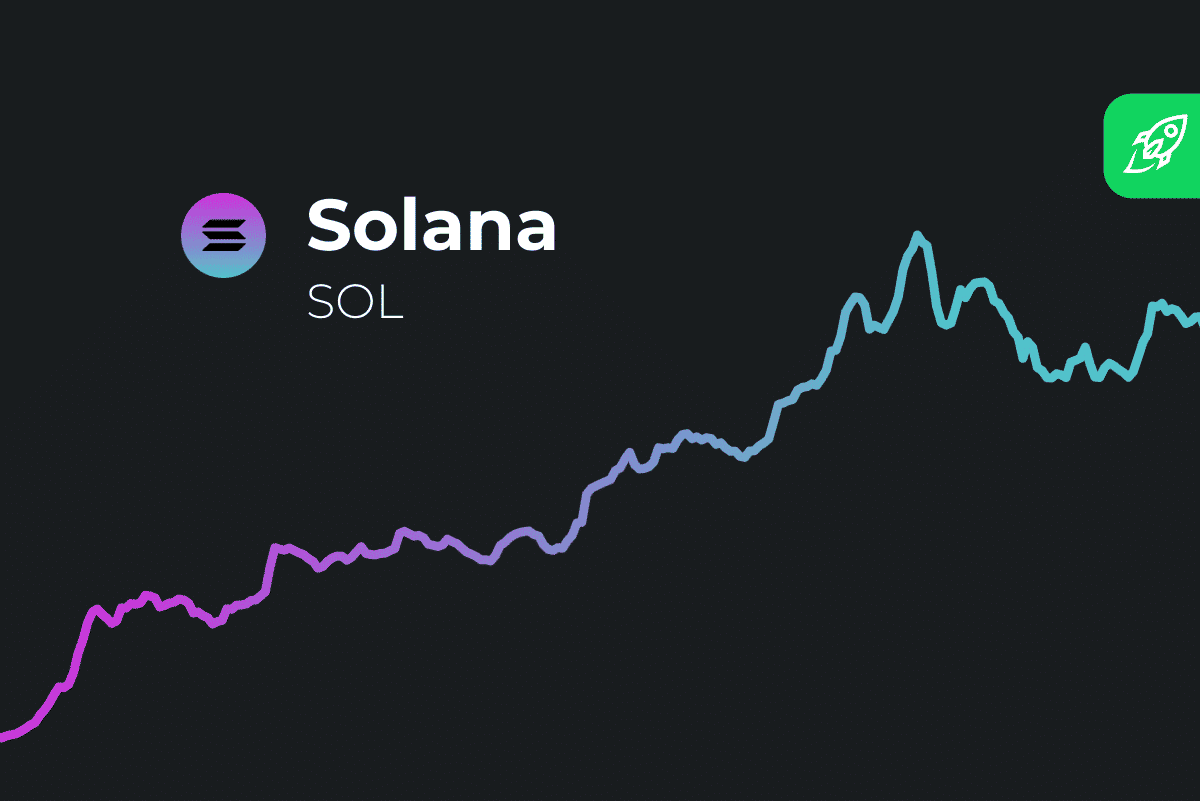

Cryptocurrencies have disrupted traditional financial systems, offering faster and cheaper transactions. They have also created new investment opportunities, with the total market capitalization of cryptocurrencies reaching $2 trillion in 2021.

Social Impact

Cryptocurrencies have empowered individuals in developing countries, providing access to financial services where traditional banking is unavailable. They have also become a tool for social causes, with organizations accepting donations.

Challenges

Despite their benefits, cryptocurrencies face challenges such as volatility, regulatory uncertainty, and environmental concerns. For example, Bitcoin mining consumes significant amounts of energy, raising questions about its sustainability.

Regulation and Future

Regulation

Governments around the world are grappling with how to regulate cryptocurrencies. Some countries, like El Salvador, have embraced them, while others, like China, have banned them. The Financial Action Task Force (FATF) has introduced guidelines for virtual asset service providers (VASPs), aiming to combat money laundering and terrorism financing.

Future Trends

- Central Bank Digital Currencies (CBDCs): Many countries are exploring the idea of issuing their own digital currencies.

- Decentralized Finance (DeFi): DeFi platforms are growing rapidly, offering financial services like lending and borrowing without intermediaries.

- NFTs: Non-fungible tokens (NFTs) are becoming popular, allowing users to own unique digital assets.

Conclusion: Is Cryptocurrency the Future of Money?

Cryptocurrency has come a long way since its inception, transforming the way we think about money and finance. While it faces challenges, its potential is undeniable. Whether it becomes the future of money or remains a niche asset, one thing is clear: cryptocurrency is here to stay.

So, are you ready to dive into this complex world? Whether you’re investing, trading, or simply exploring, the journey is just beginning.

Disclaimer: Cryptocurrencies are highly volatile and involve significant risks. Always do your own research and invest responsibly.