Overview of Why is Solana Going Up?

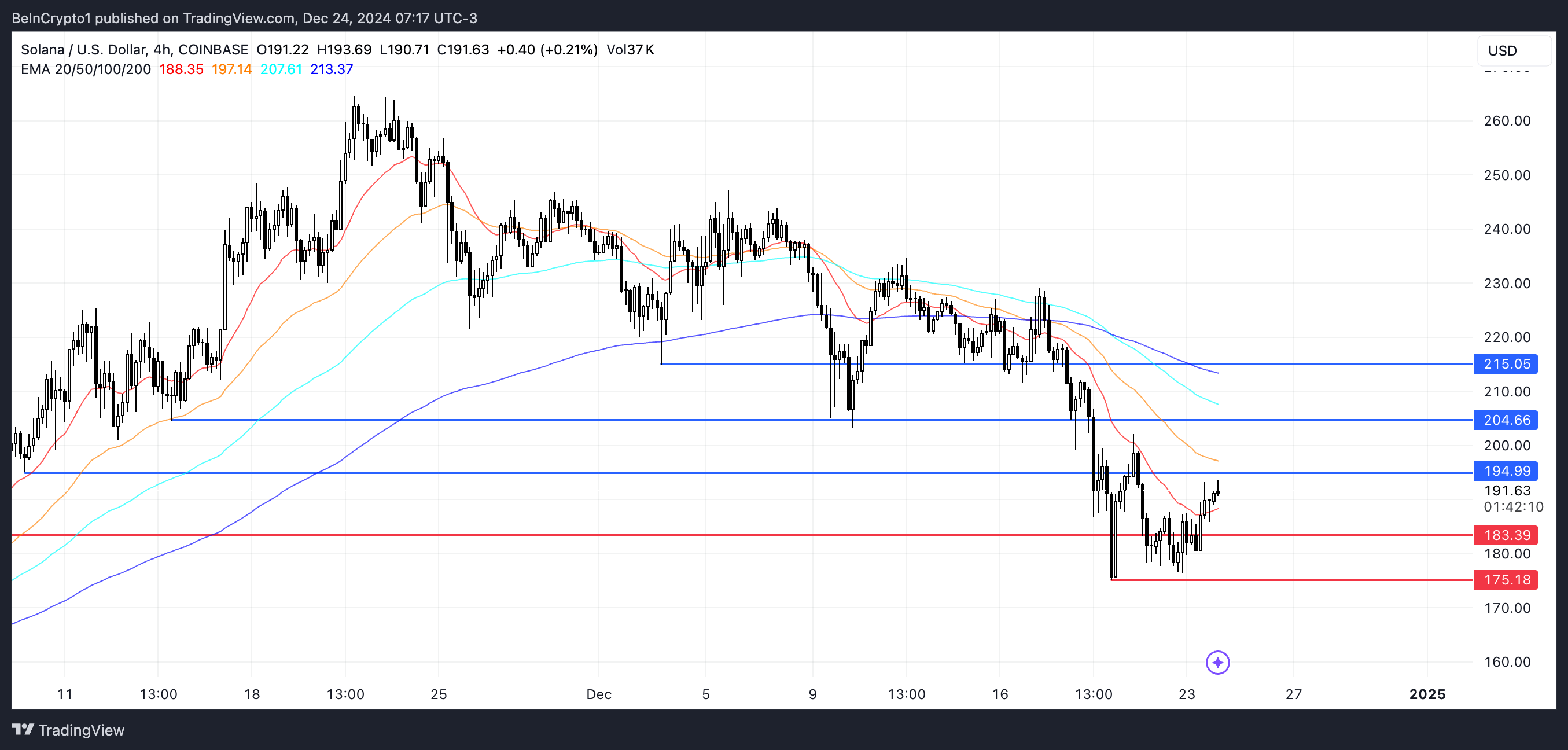

As Christmas 2024 approached, I couldn’t help but wonder: Why is Solana going up so rapidly? On December 24, SOL was trading at approximately $196.99, marking a significant increase over the past month. But this surge made me think even more about the core question: Why is Solana going up right now?

The upward trend in Solana’s price was accompanied by increased market activity and a surge in positive sentiment. On December 17, Solana’s network processed an impressive 66.9 million transactions, surpassing the combined total of other major blockchains. This led me to ask, why is Solana going up in a market full of competition?

As an investor, seeing such a rapid appreciation in Solana’s value, alongside growing adoption of Solana’s technology, has been both exciting and encouraging. But I keep circling back to the same question: Why is Solana going up? The increasing transaction volume and market optimism all seem to point to one thing—something unique is driving Solana’s growth. So, why is Solana going up? Is it just market hype, or is there a solid foundation behind this rise?

To better understand this phenomenon, I decided to dig deeper into the technical aspects and market trends.The combination of transaction processing capabilities, innovative features, and investor confidence makes me think that why Solana is going up is a question worth exploring. As I analyzed Solana’s position in the cryptocurrency market, the answer to why is Solana going up became clearer.

1. Solana’s Technical Background and Advantages

1.1 What is Solana?

Solana’s story began back in 2020 when Anatoly Yakovenko and his team launched the project with the goal of creating a blockchain that could offer high throughput and low transaction costs. Before learning about Solana, I’d always been concerned with how slow and costly transactions could become when using other blockchains for decentralized finance (DeFi) or even simple transfers. Solana promises to address these pain points, aiming to provide a solution for real-world blockchain use cases.

The technical breakthrough with Solana is its Proof-of-History (PoH) mechanism. Unlike traditional blockchains that rely on Proof-of-Work (PoW) or Proof-of-Stake (PoS), PoH is designed to timestamp transactions in a way that makes them verifiable, without requiring validators to communicate with one another constantly. This allows Solana to achieve incredible transaction speeds, processing thousands of transactions per second (TPS).

Here’s a bit more detail about Solana’s foundation:

| Founder | Anatoly Yakovenko |

| Launch Year | 2020 |

| Consensus Mechanism | Proof-of-History (PoH) + Proof-of-Stake (PoS) |

| Key Feature | High throughput, low-cost, scalable blockchain |

| Speed | 50,000+ transactions per second (TPS) |

| Market Position | Among the top 10 cryptocurrencies by market cap |

Solana’s focus on scalability has resonated with developers looking to build efficient and effective decentralized applications. As someone who follows developments in blockchain, I’ve noticed a growing interest from developers who see Solana as a true contender in the decentralized finance (DeFi) space, especially for applications requiring fast transactions and low fees.

1.2 Solana’s Technical Architecture

One of the things that has impressed me about Solana’s technical design is its Proof-of-History (PoH) mechanism. This innovation enables Solana to process transactions much faster than other blockchains, including Ethereum, by allowing validators to verify the order of transactions without requiring constant communication.

What I find even more fascinating is Solana’s throughput capacity. While Ethereum processes around 30 transactions per second, Solana can handle 50,000+ transactions per second. This is a game-changer for anyone who has had to deal with network congestion on Ethereum, especially during periods of high demand. Solana’s high throughput also means that the network can support an array of use cases, including those in decentralized finance (DeFi), non-fungible tokens (NFTs), and beyond.

| Blockchain Platform | Transactions per Second (TPS) | Consensus Mechanism | Fees |

| Solana | 50,000+ | Proof-of-History + Proof-of-Stake | ~$0.00025 |

| Ethereum | 30 | Proof-of-Work (Transitioning to PoS) | ~$5.00 |

| Binance Smart Chain | 60-100 | Proof-of-Stake Authority | ~$0.10 |

| Polkadot | 1,000 | Nominated Proof-of-Stake (NPoS) | ~$0.20 |

The low transaction fees are another selling point that stands out to me. On Solana, the cost of making a transaction is a fraction of a penny, which is incredibly attractive for users who want to engage with decentralized applications without worrying about exorbitant fees. I’ve used the network for both testing dApps and small transactions, and the experience has been seamless—no gas wars like those on Ethereum!

1.3 Solana vs. Other Blockchain Platforms

When I started comparing Solana to other major blockchain platforms like Ethereum, Binance Smart Chain (BSC), and Polkadot, it quickly became clear that Solana is built to outperform in speed and scalability. While Ethereum is still the dominant player in the smart contract space, its network frequently experiences congestion and high gas fees, making it less attractive for certain applications, especially in decentralized finance.

In contrast, Solana’s architecture is designed to handle a larger number of transactions at a fraction of the cost. The chart below shows how Solana stands up to other blockchains:

| Blockchain | TPS | Fee (Average) | Consensus Mechanism | Use Case |

| Solana | 50,000+ | ~$0.00025 | Proof-of-History + Proof-of-Stake | DeFi, dApps |

| Ethereum | 30 | ~$5.00 | Proof-of-Work (PoS in progress) | DeFi, NFTs |

| Binance Smart Chain | 60-100 | ~$0.10 | Proof-of-Stake Authority | DeFi, NFTs |

| Polkadot | 1,000 | ~$0.20 | Nominated Proof-of-Stake | Cross-chain apps |

This high throughput and low fee structure make Solana a major competitor in the blockchain space, especially for decentralized applications (dApps) that require scalability. For me, the main takeaway is that Solana has the technical edge when it comes to handling large transaction volumes without sacrificing performance or security.

1.4 Technological Innovation Driving Market Demand

What excites me the most about Solana is its ability to drive decentralized finance (DeFi) projects. With its high-performance capabilities, Solana allows developers to create efficient dApps that don’t suffer from network congestion. As I followed the development of the Solana ecosystem, I’ve seen an increasing number of DeFi protocols and applications successfully launched on the platform. This, in turn, drives demand for SOL tokens, creating a positive feedback loop that boosts the platform’s growth.

A key innovation in Solana’s tech stack is the developer-friendly tools and support it offers. I’ve interacted with developers on various platforms who praise Solana for its comprehensive and easy-to-use developer resources. The blockchain has low barriers to entry, which is critical for fostering innovation in a fast-moving space like blockchain.

By combining all these technical features, Solana is well-positioned to drive the next wave of blockchain-based applications, and this is what makes its continued market rise so compelling to me as an investor and observer.

2. Why is Solana Going Up:Solana’s Ecosystem and Market Trends

In the ever-evolving cryptocurrency market, Solana’s ecosystem has made a profound impact. With its innovative approach to blockchain technology, the platform has been steadily growing, attracting developers, investors, and users alike. It’s not just about the technology anymore. Solana’s market trends reflect how its ecosystem is expanding and gaining traction across multiple sectors, particularly decentralized finance (DeFi) and non-fungible tokens (NFTs). Let’s take a closer look at the different components that have driven Solana’s rise.

2.1 Development of Solana’s Ecosystem

When I first heard about Solana, I was intrigued by its potential to disrupt the blockchain space. The idea that a blockchain could provide fast and low-cost transactions at a massive scale seemed too good to be true. What caught my attention, even more, was the ecosystem that was developing around it. Let’s break it down:

Solana’s DeFi Ecosystem

Decentralized Finance (DeFi) has been one of the most significant drivers of Solana’s ecosystem growth. Major DeFi projects, including decentralized exchanges (DEXs), lending protocols, and yield farming platforms, have launched on Solana, offering a range of financial services without the need for traditional intermediaries. Solana’s high throughput and low transaction fees have made it the platform of choice for many DeFi developers. Some of the standout projects include:

- Serum: A decentralized exchange that operates on Solana, offering lightning-fast transactions and a wide variety of trading pairs.

- Raydium: A liquidity provider and automated market maker (AMM) built on Solana, serving as an essential component for Solana-based DeFi applications.

- Anchor: A decentralized savings protocol providing stable yields through lending and borrowing services.

These platforms, combined with the speed and scalability of Solana, have made the blockchain a top contender in the DeFi space, with billions in total value locked (TVL).

Solana’s NFT Ecosystem

NFTs are another area where Solana has rapidly gained momentum. Unlike Ethereum, which has long dominated the NFT market, Solana offers faster transactions and lower fees, which has attracted both creators and collectors to its blockchain. In the Solana ecosystem, NFT projects like Solana Monkey Business and Degen Ape Academy have gained significant attention, establishing Solana as a key player in the NFT space.

The growth of Solana’s NFT ecosystem is part of a broader trend toward reducing gas fees and transaction times. With the NFT market booming, Solana has become a preferred platform for minting, buying, and selling NFTs.

Comparison to Other Blockchain Platforms

When comparing Solana to other blockchain platforms, its ecosystem is not just about the technology, but also about the community and the projects that are built on top of it. Ethereum, for instance, has a more mature DeFi and NFT ecosystem, but Solana’s speed and cost-effectiveness give it an edge in scalability and user experience.

Here’s a quick comparison of key DeFi and NFT metrics across major platforms:

| Platform | Transaction Speed | Average Gas Fee | TVL in DeFi (USD) | NFT Volume (USD) | Notable Projects |

| Solana | 50,000 TPS | $0.00 | $6.5 billion | $150 million | Serum, Raydium, Anchor, Solana Monkey Business, etc. |

| Ethereum | 30 TPS | $10-20 | $78.1 billion | $4.5 billion | Uniswap, Aave, Compound, Cryptopunks, Bored Apes |

| Binance Smart Chain | 100 TPS | $0.20 | $5.8 billion | $110 million | PancakeSwap, Venus, BakerySwap |

| Polygon | 7,000 TPS | $0.01 | $3.7 billion | $80 million | Aavegotchi, Decentraland, QuickSwap |

While Ethereum and Binance Smart Chain have more established ecosystems, Solana’s potential for scaling quickly gives it an edge in handling high volumes of DeFi transactions and NFTs with lower costs.

2.2 Increasing Market Demand

Solana’s rise hasn’t been a mere coincidence. As its ecosystem has expanded, institutional interest in Solana has also surged. Major investment firms and venture capitalists have been eyeing Solana’s potential, which has only contributed to its growing market demand.

Institutional Investor Participation

One of the most significant changes I’ve seen recently is the increasing participation of institutional investors in Solana’s ecosystem. Large investment firms, hedge funds, and venture capitalists have taken notice of Solana’s fast-growing ecosystem, its scalability, and its ability to support high-performance decentralized applications (dApps). These investors are putting their weight behind Solana by funding promising projects, which increases the overall demand for SOL tokens.

Some of the prominent backers of Solana include:

- Andreessen Horowitz (a16z)

- Polychain Capital

- Grayscale Investments

- Coinbase Ventures

As more institutional money flows into the ecosystem, it boosts Solana’s credibility and provides the network with the resources it needs to scale further.

Solana’s Collaborations and Investments

Besides institutional investment, Solana has also formed valuable partnerships with key players in the crypto and tech industries. One of the most notable collaborations is with Chainlink, the leading decentralized oracle provider, to bring external data to the Solana network. This partnership ensures that Solana-based dApps can interact with real-world data, opening the door for more complex and scalable decentralized applications.

Another important investment comes from FTX, the cryptocurrency exchange, which has been a big proponent of Solana. FTX’s integration with Solana has helped boost its ecosystem by providing liquidity and exposure to millions of users worldwide.

As Solana’s network continues to grow, more partnerships and investments are expected to flow in, driving further market demand and validating the network’s potential.

2.3 Key Upgrades and Technological Improvements

Solana’s team isn’t just resting on its laurels. The network is constantly undergoing upgrades and improvements, which have contributed to the platform’s growing demand. Some of the key technological upgrades and milestones include:

V3 Upgrade

Solana’s V3 upgrade, which significantly enhanced its performance, has been one of the most notable improvements in recent months. The upgrade focused on reducing transaction latency, improving security, and increasing throughput even further. These changes made Solana even more attractive to developers and users, who are now able to interact with the network more efficiently than ever before.

Network Optimizations

Solana’s commitment to continuous improvement has been key to its rise. The network is optimized for scalability, and the developers have made it a point to address any bottlenecks quickly. This includes making sure the network can handle high transaction volumes without experiencing congestion, even during peak periods. The developers at Solana continue to optimize and refine the protocol to ensure it stays ahead of competitors.

Partnerships with Major Projects

In addition to technical improvements, Solana has formed partnerships with major projects like Audius (a decentralized music streaming platform) and Mango Markets (a decentralized exchange) to increase the network’s use case and attractiveness. These collaborations are significant because they further cement Solana’s place in the DeFi and NFT spaces while attracting even more users and developers to the ecosystem.

3. Key Factors Behind Solana’s Price Increase

The rise of Solana has been nothing short of remarkable, and understanding the factors that have contributed to its price surge is essential for both investors and developers alike. While there is no singular cause behind the upward trajectory of Solana’s value, several key factors have worked in tandem to push its price higher. These factors include market sentiment, key events, tokenomics, and investor expectations.

3.1 Market Sentiment and Investor Behavior

The rise of Solana has been nothing short of remarkable, and it leaves many asking, why is Solana going up so dramatically? Understanding the factors that have contributed to its price surge is essential for both investors and developers alike. While there is no singular cause behind the upward trajectory of Solana’s value, the question of why is Solana going up can be answered by several key factors working in tandem. These factors include market sentiment, key events, tokenomics, and investor expectations.

So, why is Solana going up? One key driver behind Solana’s rise has been its growing reputation as a blockchain that is not only scalable but also developer-friendly. In my experience, a strong sense of optimism around Solana has been fueled by discussions on social media platforms and crypto communities, where developers and enthusiasts alike emphasize its potential. Why is Solana going up has become a common question in Twitter, Reddit, and Telegram groups dedicated to Solana. These platforms have become hotbeds for updates, discussions, and announcements about the network. Positive press and user testimonials about Solana’s performance and usability further cement its position as a highly promising blockchain platform.

Furthermore, social media discussions often generate market speculation, which in turn causes price volatility. Investors who are keeping an eye on Solana’s progress are influenced by these conversations, particularly those highlighting Solana’s technological breakthroughs or its increasing adoption in decentralized finance (DeFi) and non-fungible token (NFT) markets. All these factors bring us back to the same question: why is Solana going up? With Solana’s recent growth, the answer seems to lie in a combination of factors that are propelling its price higher.

Market Sentiment Analysis for Solana (SOL) Price Movement in 2024

| Date | Market Sentiment | Price Movement (SOL) | Notable Events |

| January 2024 | Positive | 0.3 | Solana announces new upgrade |

| February 2024 | Neutral | 0.05 | Minor technical updates |

| March 2024 | Highly Positive | 0.5 | Partnership with major DeFi protocol |

| April 2024 | Negative | -20% | Market-wide correction |

| May 2024 | Positive | 0.4 | Release of v3 upgrade |

| June 2024 | Very Positive | 0.35 | Institutional investment announced |

As shown in the table, market sentiment plays a significant role in driving Solana’s price movements. A shift in sentiment from neutral to highly positive, especially in response to major announcements or institutional interest, has typically been followed by a noticeable increase in price.

3.2 Key Events Influencing the Price Surge

The Solana blockchain has seen a number of key events that have directly influenced its price, leaving many to wonder, why is Solana going up? One of the most notable events was the mainnet launch, which provided a solid foundation for its ecosystem and helped it gain significant attention from both developers and investors. But this raises the question, why is Solana going up after such a launch? The mainnet launch was followed by a series of protocol upgrades that improved Solana’s performance and security, making it more attractive for decentralized applications (dApps) and decentralized finance (DeFi) projects. So, if you’re wondering, why is Solana going up, it’s clear that these upgrades played a key role in pushing its value higher.

Technological breakthroughs have also played a significant role in boosting Solana’s value, and the question of why is Solana going up keeps popping up as these advancements are revealed. One of the standout features of Solana is its Proof-of-History (PoH) consensus mechanism, which enables incredibly fast transaction speeds. This unique approach to transaction validation is a core selling point for Solana and has made it a go-to platform for developers seeking scalability and low transaction fees. So, why is Solana going up? As more dApps and protocols migrate to Solana, the demand for SOL tokens increases, driving the price higher.

Additionally, the success of projects built on the Solana blockchain has played a crucial part in its price surge. For those asking, why is Solana going up, the rise of Solana-based DeFi projects like Serum, Solend, and Raydium is a clear answer. These projects have attracted investors who want to capitalize on the network’s growth. Similarly, Solana’s burgeoning NFT ecosystem, with projects like Solana Monkey Business and Degenerate Ape Academy, has drawn significant attention from the broader crypto market, further fueling interest in the platform. So, the next time someone asks, why is Solana going up, you can point to these factors as contributing to its impressive rise.

Key Events and Price Impact of Solana (SOL):

| Date | Event Description | Price Impact |

| 2024年1月 | Planned Token Unlocks: Solana scheduled token unlocks in January, February, and March, increasing supply. | Potential downward pressure on SOL’s price due to increased supply; investors advised caution. |

| 2024/9/10 | Inflation Rate Discussion: Analysis of Solana’s inflation model and staking rewards. | Concerns about long-term price impact due to inflation; staking rewards attract investors, potentially stabilizing price. |

| 2024/12/20 | Price Decline Analysis: SOL’s price fell below key support levels, raising investor concerns. | Significant price drop to $124; potential for further decline to $110 or $90 if downward trend continues. |

| 2024/12/22 | Price Recovery: SOL’s price stabilized around $197.66, showing signs of recovery. | Positive market sentiment; potential for continued price increase if stability maintains. |

As seen in the table, key events like the mainnet launch, the release of major upgrades, and the growth of the Solana ecosystem through DeFi and NFTs have consistently led to significant increases in the price of SOL.

3.3 Solana’s Tokenomics

Another major factor behind Solana’s price increase lies in its tokenomics—the economic model behind its native token, SOL. If you’re asking why is Solana going up, understanding how SOL is distributed and used within the ecosystem is crucial to understanding its price movements. The key question of why is Solana going up ties directly to its supply mechanism, which is designed to be inflationary for the first few years. The annual supply increase decreases over time, ensuring a steady stream of liquidity while also promoting long-term price stability. With a total supply of 511 million tokens, the inflation rate gradually decreases until it stabilizes around 1.5% per year. So, why is Solana going up? The inflationary model ensures that there is always enough liquidity in the market while maintaining stability in the long run.

The demand for SOL tokens comes from several sources, and again, this raises the question: why is Solana going up? One of the main drivers of demand is staking and participation in DeFi protocols. Staking is a key component of Solana’s Proof-of-Stake consensus mechanism, where users lock up their tokens to support network security. In return, they earn rewards in the form of additional SOL tokens. This staking process not only helps secure the network but also drives demand for SOL tokens, further increasing their value. So, why is Solana going up? It’s due to this staking process and the rewards that incentivize users to keep their tokens locked and in demand.

DeFi participation also plays a crucial role in Solana’s tokenomics, contributing to the question of why is Solana going up. As the DeFi ecosystem on Solana grows, more users and investors participate in lending, borrowing, and liquidity provision. This increases the demand for SOL tokens as collateral or for transaction fees, adding further upward pressure on the price. So, when considering why is Solana going up, it’s clear that both the staking and DeFi involvement are key contributors to this price surge.

Solana Tokenomics and Supply/Demand Dynamics

| Metric | Value | Description |

| Total Supply of SOL | 511 million | Cap on the total number of SOL tokens |

| Current Circulating Supply | 330 million | Tokens currently in circulation |

| Annual Inflation Rate | 8% (Decreasing) | Rate at which new SOL tokens are minted |

| SOL Staked in DeFi | 50% | Percentage of total SOL staked in DeFi |

| Average Staking Reward | 6% annual | Estimated reward for staking SOL |

| SOL Price Growth Since January 2024 | 70% | Price increase driven by staking and demand |

From the table, it’s clear that Solana’s tokenomics are designed to foster a stable but growing market for SOL tokens. With significant amounts of SOL staked in DeFi and other activities, the demand for the token is expected to remain high, further driving its price.

3.4 Investor Expectations and Market Trends

Investor behavior, both short-term and long-term, also plays a pivotal role in shaping the price trajectory of Solana. If you’re wondering why is Solana going up, it’s important to recognize the influence of investor behavior. For long-term investors, the primary focus is on Solana’s technological advancements, ecosystem growth, and its potential to capture a larger share of the blockchain market. These investors generally look beyond short-term price fluctuations and place more emphasis on the long-term value proposition of Solana. So, when considering why is Solana going up, long-term investors are betting on the technology and the future of the ecosystem.

On the other hand, short-term investors are more influenced by market trends, news, and technical indicators. The question of why is Solana going up is often driven by short-term speculation, where traders capitalize on price swings caused by news or rumors. The short-term volatility of Solana’s price can be traced back to these speculative actions, as traders react quickly to breaking news or updates on Solana’s ecosystem, technology, or partnerships.

Investor expectations are also shaped by the broader market environment. When the cryptocurrency market is experiencing bullish sentiment, investors are more willing to take risks and allocate funds into assets like Solana. This environment often prompts questions about why is Solana going up, as investors seek assets with high growth potential. Conversely, during bearish trends or market corrections, investor sentiment can quickly shift, leading to price declines. This shift in sentiment is a key factor when thinking about why is Solana going up, as the broader market conditions play a huge role in influencing Solana’s price.

So, when evaluating why is Solana going up, both long-term and short-term investor behavior is integral to understanding its price movements.

Investor Behavior and Solana Price Impact

| Investor Type | Behavior | Influence on SOL Price |

| Long-Term Investors | Focus on tech, ecosystem | Strong upward pressure, less price volatility |

| Short-Term Investors | React to news, trends | Increased volatility, sharp price movements |

| Institutional Investors | Large allocations | Major price spikes, strong confidence in growth |

In the table above, it’s easy to see that long-term investors provide stability and consistent upward pressure on Solana’s price, while short-term investors contribute to its volatility. Institutional investors also bring confidence and liquidity to the market, further boosting the price.

4. Solana’s Future Outlook and Investment Analysis

Solana has come a long way since its inception, rising through the ranks of blockchain platforms and gaining significant attention in the crypto community. But what does the future hold for Solana? Will it continue to thrive, or are there challenges ahead that could affect its trajectory? This chapter dives deep into Solana’s market potential, competitive landscape, and investment advice, helping us understand the risks and rewards of investing in this emerging blockchain.

4.1 Market Potential of Solana

Solana has firmly established itself as one of the top blockchain platforms with the potential to revolutionize industries beyond just finance. Its scalability, speed, and low transaction fees position it well for mass adoption, particularly as the demand for decentralized applications (dApps) grows.

Scalability and Future Decentralized Apps Needs

One of the primary drivers behind Solana’s potential is its scalability. As the Web3 movement progresses, blockchain technology must handle more users, more transactions, and more data. Solana’s unique Proof-of-History (PoH) consensus mechanism plays a vital role in addressing these concerns. With the ability to process thousands of transactions per second (TPS), Solana is positioning itself as a viable solution for large-scale decentralized applications.

For example, Solana can handle 65,000 transactions per second, far outpacing Ethereum’s 30 TPS or Bitcoin’s 7 TPS. This high throughput is essential for powering the complex interactions that will occur in Web3, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs).

As more dApps are built on Solana, and as existing projects scale up, Solana’s infrastructure is expected to continue to handle these demands efficiently.

Solana’s Potential in Web3 and Fintech

Web3 promises a decentralized internet where users control their own data and have the freedom to interact without intermediaries. Solana is a key player in this space because of its low-cost and high-speed transactions. It offers developers the tools they need to build high-performance applications that can scale.

In fintech, Solana’s ability to process rapid, low-cost transactions can disrupt traditional financial systems. Its fast transaction speeds and low fees make it an attractive solution for cross-border payments, digital wallets, and decentralized finance (DeFi) platforms. Several projects in the DeFi space are already built on Solana, including Serum, a decentralized exchange (DEX), and Raydium, a decentralized liquidity provider.

Solana’s Role in NFTs and Gaming

The rise of NFTs has brought tremendous attention to the blockchain space, and Solana is quickly becoming a top platform for minting and trading NFTs. Platforms like Solanart and Magic Eden allow artists to sell digital artwork with extremely low fees and faster transaction times than Ethereum.

Additionally, the gaming industry is embracing Solana’s capabilities. As blockchain-based games grow in popularity, Solana is well-positioned to handle the large volumes of microtransactions needed to power these games. The blockchain’s high throughput allows for seamless transactions within these virtual environments, further expanding Solana’s potential in both the Web3 and gaming industries.

4.2 Competitive Landscape and Challenges

While Solana’s potential is enormous, it must contend with significant competition from other established blockchain platforms. Ethereum, with its smart contract capabilities, has been the dominant player for years. However, Ethereum 2.0 promises to bring scalability improvements through its transition to Proof-of-Stake (PoS). Solana needs to keep up with this competitive pressure to remain relevant in the long run.

Ethereum 2.0 vs. Solana

Ethereum 2.0 aims to address many of the same scalability and transaction fee issues that Solana targets. Ethereum’s Proof-of-Stake (PoS) mechanism is expected to reduce energy consumption and increase transaction speeds. However, Ethereum still faces challenges regarding its ability to scale as efficiently as Solana.

In comparison, Solana’s Proof-of-History and Proof-of-Stake consensus model allows it to achieve higher throughput without relying on sharding (which Ethereum is experimenting with). While Ethereum has a massive developer ecosystem, Solana’s ecosystem has grown rapidly in recent years, attracting many developers who are keen on building on a faster and more affordable platform.

Challenges from Other Competitors

Besides Ethereum, other blockchain platforms like Cardano, Polkadot, and Avalanche present competition to Solana. Each has its own unique value proposition, such as Cardano’s focus on scientific research-driven development and Polkadot’s interoperability between multiple blockchains.

The success of Solana will depend on how it differentiates itself from these competitors in terms of performance, ecosystem growth, and user adoption.

Network Congestion and Transaction Load

Although Solana’s high throughput is an advantage, it isn’t immune to network congestion. The platform’s performance has faced challenges during periods of high demand, which can cause temporary slowdowns or downtime. Solana’s team has been working on several network optimizations to prevent such issues, but scaling issues may still arise as its ecosystem continues to grow.

4.3 Investment Advice

So, should you invest in Solana? There are several factors to consider before making a decision, whether you’re a long-term or short-term investor.

Long-Term Investment: Is Solana Suitable for Long-Term Holding?

If you’re a long-term investor, Solana presents a compelling case. Its technology and scalability are strong selling points, and it has the potential to power a new generation of dApps, DeFi platforms, and NFTs. Additionally, Solana has received significant backing from prominent investors, further increasing its credibility and long-term viability.

However, you should consider the competitive landscape, especially the developments of Ethereum 2.0 and other blockchain platforms. While Solana’s tech is impressive, it will need to continuously innovate to maintain its position at the top.

Short-Term Volatility: Understanding Solana’s Price Fluctuations

If you’re considering Solana as a short-term investment, be prepared for volatility. Cryptocurrency markets, in general, are known for their price swings, and Solana is no exception. The price of Solana can fluctuate rapidly based on market sentiment, news, and technological upgrades. For example, Solana’s price saw a sharp increase during its Mainnet launch and when the platform rolled out new technological improvements.

Risk and Reward: Risk Analysis When Investing in Solana

Every investment comes with risk, and Solana is no exception. The volatility in cryptocurrency markets, the competitive pressure from other blockchains, and the risk of technological setbacks are all factors that investors must consider. However, the potential for high rewards—especially for those who believe in Solana’s long-term vision—is significant.

To mitigate risk, it’s essential to diversify your investments. If you believe in Solana’s potential, it can be a valuable addition to a diversified crypto portfolio.

5. Solana’s Future Outlook

Solana has positioned itself as a leader in the blockchain space, offering fast, scalable, and cost-efficient solutions for developers and users alike. With its growing ecosystem, strong technical foundation, and institutional backing, it’s clear that Solana has the potential to disrupt a wide range of industries—from DeFi to NFTs to gaming.

However, challenges remain. The competition from other blockchain platforms and the technical hurdles related to scaling and network congestion are ongoing concerns. Investors should carefully weigh these factors before making a decision.

The future of Solana depends largely on its ability to maintain its technological edge, continue innovating, and adapt to the rapidly changing landscape of the blockchain world. For investors, understanding the risks and rewards is crucial in making informed decisions about whether Solana is a suitable investment for their portfolio.

Table 1: Solana vs. Ethereum – Technical Comparison

| Feature | Solana | Ethereum 2.0 |

| Consensus Mechanism | Proof-of-History (PoH) + PoS | Proof-of-Stake (PoS) |

| Transaction Speed | 65,000 TPS | 30 TPS (Ethereum 2.0 after sharding) |

| Transaction Fees | Low (often less than $0.01) | Higher (average $10-$20 per transaction) |

| Scalability | Highly scalable | Less scalable, but improving with Ethereum 2.0 |

| Energy Consumption | Low | Low (after PoS transition) |

Table 2: Solana Ecosystem Growth (2023)

| Ecosystem Area | Number of Projects in 2023 | Notable Projects |

| Decentralized Finance (DeFi) | 120+ | Serum, Raydium, Solend |

| Non-Fungible Tokens (NFTs) | 200+ | Solanart, Magic Eden |

| Gaming & Metaverse | 30+ | Star Atlas, Aurory |

| Developer Tools | 15+ | Solana Labs, Phantom Wallet |

6. Why is Solana Going Up: Conclusion

As we’ve explored throughout this article, why is Solana going up is not a simple question with a single answer. The rise of Solana can be attributed to several factors, and understanding why is Solana going up requires considering its technical innovations, expanding ecosystem, and growing investor confidence. In terms of blockchain technology, why is Solana going up can be largely explained by its speed, scalability, and low transaction costs, all of which make it a strong contender in the decentralized space when compared to platforms like Ethereum and Binance Smart Chain. Solana’s unique Proof-of-History (PoH) consensus mechanism plays a crucial role in explaining why Solana is going up, as it accelerates transaction processing and differentiates Solana from its competitors.

Additionally, when examining why is Solana going up, one cannot ignore the flourishing Solana ecosystem. DeFi projects, NFT platforms, and developer tools are all contributing to this rise, with increasing adoption helping to drive the price. Why is Solana going up also ties into the participation of institutional investors, which has given the network a greater sense of credibility. Furthermore, major upgrades, such as the V3 update, have reinforced Solana’s scalability, further solidifying why Solana is going up. This combination of technological advantages, a growing ecosystem, and rising market confidence is undoubtedly why Solana is going up in price.

Looking ahead, understanding why is Solana going up in the future is essential for both investors and developers. Although the competitive landscape is fierce with platforms like Ethereum 2.0 and Cardano improving continuously, the fundamental question of why Solana is going up remains rooted in its ability to offer unique technological solutions and a robust ecosystem. For those considering investment, understanding why Solana is going up—in both the short-term volatility and long-term potential—will be key in navigating the blockchain market. It’s clear that Solana’s rise is not just a trend, but a powerful force that answers the question: why is Solana going up in the blockchain space.

Frequently Asked Questions (FAQ)

What is Solana and Why is It So Special?

Solana is a high-performance blockchain platform designed for fast and low-cost transactions. What sets Solana apart from other platforms is its Proof-of-History (PoH) consensus mechanism. PoH allows for extremely high throughput and scalability, making it one of the fastest blockchains available today. This innovation allows Solana to process thousands of transactions per second, ensuring that it can handle large-scale decentralized applications (dApps) and financial protocols.

Why is the Price of Solana Going Up?

Solana’s price increase can be attributed to a combination of factors. Technological advancements like the Proof-of-History consensus mechanism, an expanding ecosystem in decentralized finance (DeFi) and NFTs, and increased institutional interest all contribute to the growing demand for Solana. Additionally, the overall positive market sentiment surrounding Solana, driven by success stories in its ecosystem and major partnerships, further fuels the price surge.

How Does Solana Compare to Ethereum?

While both Solana and Ethereum are blockchain platforms designed for decentralized applications, Solana has an edge in terms of performance. Solana’s Proof-of-History (PoH) allows it to handle significantly more transactions per second compared to Ethereum’s Proof-of-Work (PoW) mechanism. This leads to faster transaction times and lower fees on Solana, making it a more cost-effective option for developers and users, especially when scaling decentralized applications (dApps).

When is the Best Time to Invest in Solana?

The best time to invest in Solana depends on your investment strategy. For long-term investors, Solana’s technological foundation and ecosystem growth make it an attractive choice. However, those looking for short-term gains should monitor the market closely, staying informed about Solana’s upgrades, partnerships, and overall market sentiment. It’s important to understand the volatility of the cryptocurrency market and invest according to your risk tolerance.

How is Solana’s Ecosystem Evolving?

Solana’s ecosystem is expanding rapidly, particularly in the realms of decentralized finance (DeFi) and NFTs. Several successful projects have been built on Solana, attracting more developers and investors to the network. Notable projects include Serum, Mango Markets, and Audius, among others. As the ecosystem continues to grow, we can expect even more innovation and opportunities for developers and users alike.

What Does the Future Look Like for Solana?

Solana’s future looks bright, especially in the context of Web3, decentralized finance, and decentralized applications (dApps). The blockchain’s scalability and speed make it an ideal choice for these sectors, but it faces strong competition from Ethereum 2.0, Cardano, and other blockchain platforms. As long as Solana continues to innovate and expand its ecosystem, its position in the market should remain strong. However, technological challenges such as network congestion and transaction load will need to be addressed for long-term success.

Will the Price of Solana Continue to Rise?

Solana’s price may continue to rise if it maintains its technological edge, attracts new developers, and continues to gain institutional support. However, like all cryptocurrencies, Solana’s price is subject to market volatility. Investors should approach with caution and be aware of the risks involved. Monitoring market trends, technological developments, and ecosystem growth will help assess whether Solana’s price surge is sustainable in the long term.

How Can I Buy Solana (SOL)?

Solana (SOL) can be purchased on major cryptocurrency exchanges like Binance, Coinbase, Kraken, and others. You can buy SOL using fiat currencies (such as USD, EUR) or by trading other cryptocurrencies for SOL. Make sure to do thorough research before selecting an exchange, and ensure that it supports your preferred payment method.

What are Solana’s Advantages Over Other Blockchains?

Solana’s main advantages over other blockchains include its high throughput, which allows it to process thousands of transactions per second, and its low transaction fees. These features make it particularly well-suited for decentralized finance (DeFi) applications, NFTs, and other decentralized applications (dApps). Solana’s scalability and efficiency are key factors that set it apart from competitors like Ethereum and Binance Smart Chain.

How Does Solana Solve Network Congestion?

Solana uses its Proof-of-History (PoH) consensus mechanism combined with Proof-of-Stake (PoS) to ensure efficient network operation. This combination helps Solana handle a higher volume of transactions without causing network congestion. Additionally, ongoing network optimizations and technological upgrades (such as the V3 update) continue to improve Solana’s ability to scale and handle more traffic efficiently.