Reasons Why Bitcoin Goes Up and Down in Value:Introduction

Bitcoin, the world’s first decentralized cryptocurrency, has gained massive popularity since its creation in 2009. As a digital asset, it has revolutionized the way people think about money, investments, and financial freedom. However, one of the most striking aspects of Bitcoin is its price volatility. The value of Bitcoin fluctuates dramatically, sometimes within hours or days. As someone who’s spent considerable time studying Bitcoin and its market movements, I can tell you that understanding the reasons behind Bitcoin’s price fluctuations is essential, especially if you’re considering investing in or utilizing Bitcoin.

In this article, we’ll dive into “Reasons Why Bitcoin Goes Up and Down in Value: Understanding the Key Drivers”, exploring the various factors that cause Bitcoin’s price to fluctuate. Whether you’re new to the world of cryptocurrency or an experienced investor, knowing these key drivers will help you make informed decisions about your investments.

Basic Reasons Why Bitcoin Goes Up and Down in Value:Behind Bitcoin’s Price Volatility

Bitcoin’s price fluctuations can be attributed to several key factors, each of which plays a significant role in determining the market value of this digital asset. Understanding these factors can help you better interpret market movements and make more strategic decisions, whether you’re an investor, a trader, or just a crypto enthusiast.

1.1 The Relationship Between Demand and Supply

At its core, Bitcoin operates on a simple economic principle: supply and demand. There are only 21 million Bitcoin in existence, and this finite supply is one of the main drivers of its value. Currently, over 19 million Bitcoin have been mined, and only a few million remain to be mined over the next several decades. This limited supply makes Bitcoin a rare asset, and scarcity often leads to increased demand.

Demand for Bitcoin fluctuates based on several factors, including investor sentiment, media coverage, and global economic conditions. When demand is high, more people want to buy Bitcoin, which drives its price up. Conversely, when demand decreases, the price tends to drop.

Let’s take a look at some historical data:

| Date | Bitcoin Price (USD) | Global Demand Indicator |

|---|---|---|

| January 2021 | $32,983 | High |

| June 2021 | $29,000 | Medium |

| November 2021 | $69,000 | Very High |

| January 2022 | $46,000 | High |

As shown in the table, Bitcoin’s price varies in relation to demand. The fluctuations are not just random; they correlate with periods of high or low interest in the market.

1.2 The Cost of Bitcoin Production: Mining and Hashing Algorithms

Another important factor contributing to Bitcoin’s volatility is the process of mining. Mining is how new Bitcoin enters circulation, and it requires a great deal of computational power. Bitcoin miners use complex algorithms to validate transactions on the network, and in exchange, they receive Bitcoin as a reward.

The Bitcoin halving event—which occurs approximately every four years—also plays a crucial role in influencing the price. During halving, the reward for mining a block is cut in half, making Bitcoin harder to mine. This reduction in rewards, combined with a fixed supply, often leads to increased scarcity, which can push prices up.

Example:

- Halving Event in 2020: The reward for mining blocks was reduced from 12.5 BTC to 6.25 BTC.

- Halving Impact: Historically, Bitcoin’s price has surged after each halving event, as reduced supply combined with steady or increasing demand often results in higher prices.

This concept of halving—along with the increased difficulty in mining—creates a scarcity effect that can push the price of Bitcoin higher. As fewer coins are being mined and offered on the market, the value of each Bitcoin can rise.

1.3 Market Sentiment and Investor Psychology

Investor sentiment plays a huge role in Bitcoin’s price fluctuations. Bitcoin’s price is driven not just by factual data, but by how investors feel about the cryptocurrency. Factors such as fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) can lead to rapid price swings.

When the media reports positively on Bitcoin—such as when major companies announce they are accepting Bitcoin or when influential figures (like Elon Musk) publicly endorse the cryptocurrency—investors often jump in, causing a price surge. However, when negative news surfaces—such as government crackdowns on Bitcoin or concerns about its environmental impact—prices tend to drop sharply.

For example, in 2021, Bitcoin’s price surged after Tesla announced that it had invested $1.5 billion in Bitcoin, and then it plummeted after China re-affirmed its crackdown on cryptocurrency mining. This kind of psychological volatility makes Bitcoin particularly sensitive to news and media attention.

1.4 The Impact of Regulatory Policies

Bitcoin’s price is also highly influenced by regulatory actions from governments around the world. Since Bitcoin is not regulated by any central authority, its value can be significantly affected by news related to government regulations.

For instance:

- China’s Crackdown: In 2021, China banned financial institutions from providing services related to cryptocurrencies, leading to a sharp drop in Bitcoin’s price.

- U.S. Regulation: Conversely, when countries like the U.S. show support for cryptocurrencies, it can have a positive impact on Bitcoin’s price. For example, when the U.S. Securities and Exchange Commission (SEC) showed signs of approving Bitcoin-related ETFs, the price of Bitcoin surged.

Regulatory uncertainty can create market instability, and any signals from governments about potential bans or legal restrictions often lead to significant price declines.

1.5 Competition and Innovation: The Impact of Other Cryptocurrencies

Although Bitcoin is often regarded as the “king” of cryptocurrencies, it is not the only digital asset on the market. Other cryptocurrencies like Ethereum, Litecoin, and Ripple can also impact Bitcoin’s price.

When new technologies and innovations emerge in the cryptocurrency space, they can shift investor interest away from Bitcoin. For example, Ethereum’s smart contract capabilities have made it an attractive alternative to Bitcoin for developers, leading some to shift their investments into Ethereum rather than Bitcoin.

Moreover, the rise of central bank digital currencies (CBDCs) may also create competition for Bitcoin as an alternative currency, potentially affecting its price. As governments experiment with digital currencies, Bitcoin’s status as the leading decentralized cryptocurrency could face challenges.

Reasons Why Bitcoin Goes Up and Down in Value:The Key Factors

In the first chapter, we explored the basic reasons behind Bitcoin’s price volatility—including the relationship between demand and supply, the cost of mining, and the impact of market sentiment. Now, let’s dive deeper into more specific factors that play a role in determining the value of Bitcoin. These factors often contribute to price fluctuations in real-time, which makes understanding them crucial for investors, financial analysts, and cryptocurrency enthusiasts alike.

2.1 Global Economic and Macroeconomic Factors

When we talk about the global economic environment, Bitcoin’s price isn’t isolated from what’s happening in the broader financial world. Bitcoin has often been referred to as a “safe-haven” asset, similar to gold, especially during times of economic turmoil or currency devaluation. This section will cover how economic crises, inflation, and central banks’ monetary policies have influenced Bitcoin’s price over the years.

Economic Crises and Bitcoin’s Role as a Hedge

In times of economic instability, Bitcoin often experiences a surge in demand. Many investors see Bitcoin as a hedge against inflation or as a store of value during uncertain times. For example, during the 2020 COVID-19 pandemic, we saw a major sell-off in traditional markets, but Bitcoin’s price remained relatively stable and even saw an increase, as more people turned to cryptocurrencies as an alternative asset.

| Event | Bitcoin Price (USD) | Traditional Market Reaction | Bitcoin Market Reaction |

|---|---|---|---|

| March 2020 COVID-19 Crash | $4,300 | Stock market crashes globally | Bitcoin remained resilient |

| November 2020 (post-pandemic recovery) | $19,000 | Traditional markets recovered | Bitcoin surged past $20,000 |

As you can see, Bitcoin tends to perform well when traditional markets falter, which has earned it the nickname “digital gold”. However, while Bitcoin may be seen as a hedge, it doesn’t always perform in the same way during all types of crises. Its volatility remains high, even during periods of inflation or financial turmoil.

How Central Banks Influence Bitcoin Prices

Central banks play a critical role in shaping global economic conditions, and their policies can significantly impact Bitcoin’s price. For example, quantitative easing (QE) programs—where central banks inject money into the economy—have often been linked to a surge in Bitcoin prices. This is because increased money supply can devalue national currencies, and Bitcoin becomes an attractive alternative.

Furthermore, interest rate decisions by central banks, like the Federal Reserve in the United States, directly affect the attractiveness of holding Bitcoin versus traditional currencies or assets. When interest rates are low, investors may look for higher returns in riskier assets like Bitcoin.

2.2 Media and News Impact

One of the biggest drivers of Bitcoin’s price fluctuations is media coverage. Positive news about Bitcoin can lead to an influx of new buyers, while negative news can create fear and panic selling. Let’s take a closer look at how news—both positive and negative—impacts market sentiment.

Positive News and Price Surge

Bitcoin tends to experience a sharp price increase when big players in the financial world publicly endorse or adopt it. For example, when PayPal announced in October 2020 that it would allow users to buy, sell, and hold Bitcoin, its price skyrocketed to over $15,000, a huge surge at the time. Similarly, Tesla’s decision to buy $1.5 billion worth of Bitcoin in February 2021 created an immediate bullish sentiment, pushing the price above $40,000.

| News Event | Bitcoin Price (USD) | Market Sentiment |

|---|---|---|

| PayPal Adopts Bitcoin (Oct 2020) | $15,000 | Positive Sentiment |

| Tesla Buys $1.5 Billion in Bitcoin (Feb 2021) | $40,000 | Overwhelmingly Positive |

| China Cracks Down on Crypto (May 2021) | $30,000 | Negative Sentiment |

Negative News and Price Decline

On the flip side, negative news can lead to FUD (fear, uncertainty, doubt) and cause a significant price decline. For example, when China imposed a ban on cryptocurrency mining and trading in May 2021, Bitcoin’s price dropped sharply, losing over 50% of its value in a matter of weeks. The China crackdown highlighted how government policies can affect Bitcoin’s price in the short term.

2.3 Technical Upgrades and Hard Forks

As a decentralized digital currency, Bitcoin undergoes continuous technical upgrades to improve its functionality and scalability. However, these upgrades can also cause significant price fluctuations.

The Impact of Upgrades: Lightning Network, Taproot Protocol

One of the most important technological developments in Bitcoin’s ecosystem is the Lightning Network, which aims to make Bitcoin transactions faster and cheaper. Upgrades like this increase Bitcoin’s usability, which can lead to an increase in demand. When the Taproot protocol was implemented in November 2021, Bitcoin’s price experienced a small but noticeable increase, as it was seen as a step forward in improving Bitcoin’s security and privacy.

| Upgrade | Date | Bitcoin Price (USD) | Effect on Bitcoin |

|---|---|---|---|

| Lightning Network Proposal | 2018 | $6,500 | Positive, but slow growth |

| Taproot Activation | November 2021 | $63,000 | Slight increase in price |

Hard Forks and Market Trust

Hard forks, which create an entirely new version of Bitcoin (such as Bitcoin Cash), can also have a significant impact on Bitcoin’s price. These forks usually result in community splits, and sometimes cause a loss of investor confidence in Bitcoin’s future. If a new cryptocurrency is perceived as better or more scalable, it can take market share from Bitcoin and lower its price.

The most famous hard fork was the Bitcoin Cash (BCH) fork in 2017, which led to a temporary drop in Bitcoin’s price. The launch of Bitcoin SV in 2018 had a similar effect, although it didn’t cause as much disruption.

2.4 Country-Specific and Regional Risks

As Bitcoin is not tied to any single country or central bank, its price is often influenced by country-specific policies and acceptance.

Bitcoin Adoption and Acceptance Globally

When more countries adopt Bitcoin, the demand increases, pushing the price up. For example, El Salvador made Bitcoin legal tender in September 2021, and this decision boosted investor confidence. However, government regulations in other countries, such as India or China, can cause Bitcoin’s price to drop.

In China’s case, the government has banned cryptocurrency mining and trading several times, each time causing a significant drop in Bitcoin’s price. Similarly, in India, news of possible bans on cryptocurrency often sends shockwaves through the market, causing uncertainty and price declines.

| Event | Country | Bitcoin Price (USD) | Impact |

|---|---|---|---|

| El Salvador Adopts Bitcoin as Legal Tender | El Salvador | $43,000 | Positive Sentiment |

| China Bans Bitcoin Mining | China | $30,000 | Negative Sentiment |

| India Discusses Crypto Ban | India | $40,000 | Fear, Uncertainty |

Reasons Why Bitcoin Goes Up and Down in Value:Predicting Bitcoin Price Fluctuations

Understanding Bitcoin’s price movements is a challenge due to its volatility. As we’ve discussed in previous chapters, Bitcoin’s price is affected by a variety of factors such as supply-demand dynamics, market sentiment, and external economic forces. But can we predict Bitcoin’s price fluctuations? In this chapter, we will explore methods and strategies used to forecast Bitcoin’s price, examining historical trends, technical and fundamental analysis, and market predictions from experts and investors.

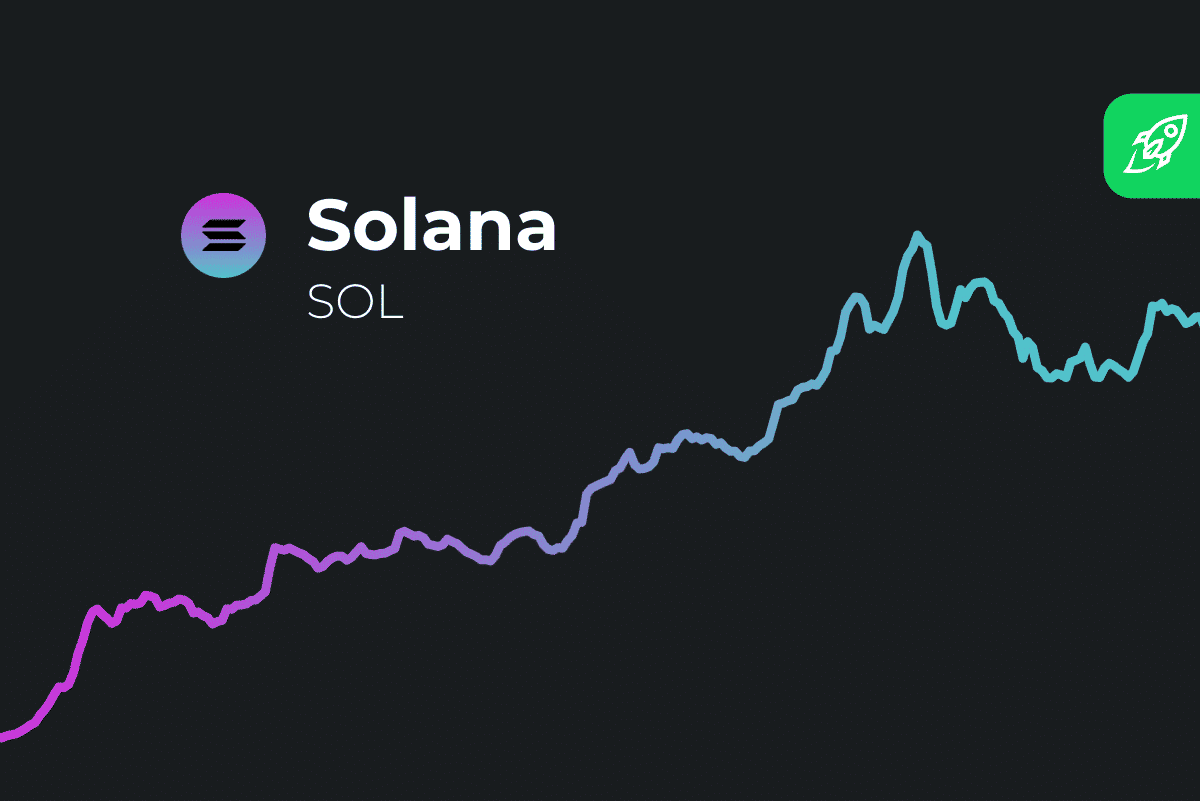

3.1 Historical Price Trends

To predict Bitcoin’s future price, it’s essential to look at its past. Over the years, Bitcoin has experienced some dramatic price movements, with periods of extreme growth followed by steep declines. These cycles are often referred to as bull markets and bear markets, with Bitcoin’s price following a predictable pattern of rises and falls.

The 2017 Bull Market and Subsequent Crash

One of the most significant price movements in Bitcoin’s history occurred in 2017, when Bitcoin surged to an all-time high (at the time) of over $19,000. This bull market was driven by factors like increased media coverage, institutional interest, and mainstream adoption. However, the price eventually collapsed in early 2018, falling back below $7,000 by the end of that year.

| Event | Date | Bitcoin Price (USD) | Impact |

|---|---|---|---|

| Bitcoin Reaches $19,000 | December 2017 | $19,000 | Bull market peak, FOMO-driven surge |

| Bitcoin Falls to $7,000 | December 2018 | $7,000 | Major correction, bear market begins |

This cycle of rapid price increases followed by corrections has become a defining feature of Bitcoin’s market behavior. Such volatility is expected to continue, making Bitcoin’s price highly cyclical.

The 2021 Surge and Crash

The year 2021 saw another massive surge in Bitcoin’s price, reaching an all-time high of nearly $69,000 in November 2021. Factors such as institutional adoption, the increasing acceptance of Bitcoin as a store of value, and the influence of global economic policies (e.g., inflation concerns) contributed to this rise. However, Bitcoin’s price again faced a sharp decline in 2022, falling to levels below $20,000 by mid-2022.

This pattern—sharp rises followed by significant corrections—is common in Bitcoin’s history and is a reflection of the speculative nature of the market.

Bitcoin’s Cyclical Price Movements

Bitcoin often follows a four-year cycle, largely driven by its halving events (discussed in earlier chapters) and broader economic cycles. These cycles are typically marked by:

- A Bull Market: A period of rising prices driven by factors such as increasing demand, technological advancements, or favorable market sentiment.

- A Peak: The point where the price reaches an all-time high and investor sentiment reaches an extreme.

- A Bear Market: A period of falling prices, often accompanied by market corrections or fear-driven selling.

- A Bottom: The point where prices reach a low, followed by the beginning of the next cycle.

Conclusion: Cycles and Predictability

While past trends show a pattern of cyclical price movements, predicting exact price points is still challenging. Bitcoin’s price movements are often influenced by a wide range of unpredictable factors, making it difficult to rely solely on historical trends.

3.2 Technical Analysis and Fundamental Analysis

Bitcoin’s price volatility is often analyzed using two primary methods: technical analysis and fundamental analysis. These tools help investors forecast potential price movements by studying historical data, price patterns, and broader economic trends.

Technical Analysis: Using Charts and Indicators

Technical analysis involves studying past market data, primarily price movements and trading volume, to forecast future price trends. Popular technical indicators include:

- Relative Strength Index (RSI): A momentum oscillator that measures the speed and change of price movements. An RSI over 70 indicates that Bitcoin might be overbought, while an RSI below 30 suggests that it could be oversold.

- Moving Average Convergence Divergence (MACD): This indicator shows the relationship between two moving averages of Bitcoin’s price. A bullish crossover (when the short-term moving average crosses above the long-term moving average) can signal a price increase, while a bearish crossover suggests a potential price decline.

- Support and Resistance Levels: These are price levels at which Bitcoin has historically had difficulty breaking through (resistance) or has found support during a decline (support). These levels can act as psychological barriers in the market.

Fundamental Analysis: Analyzing the Bigger Picture

While technical analysis focuses on price movements, fundamental analysis looks at the underlying economic factors that affect Bitcoin’s value. These include:

- Adoption Rate: The more people, institutions, and countries adopt Bitcoin, the higher the potential demand, which could push the price up.

- Regulatory Developments: Changes in government policies and regulations can significantly impact Bitcoin’s price. A favorable regulatory environment can drive prices up, while restrictions and bans can cause a sharp decline.

- Global Economic Conditions: As we discussed earlier, factors such as inflation, currency devaluation, and economic crises often drive people to seek alternative assets like Bitcoin, increasing its demand.

Combining Both Approaches

Many investors use a combination of both technical and fundamental analysis to make more accurate predictions. For instance, technical analysis can provide short-term insights into price movements, while fundamental analysis offers a broader understanding of the long-term market direction.

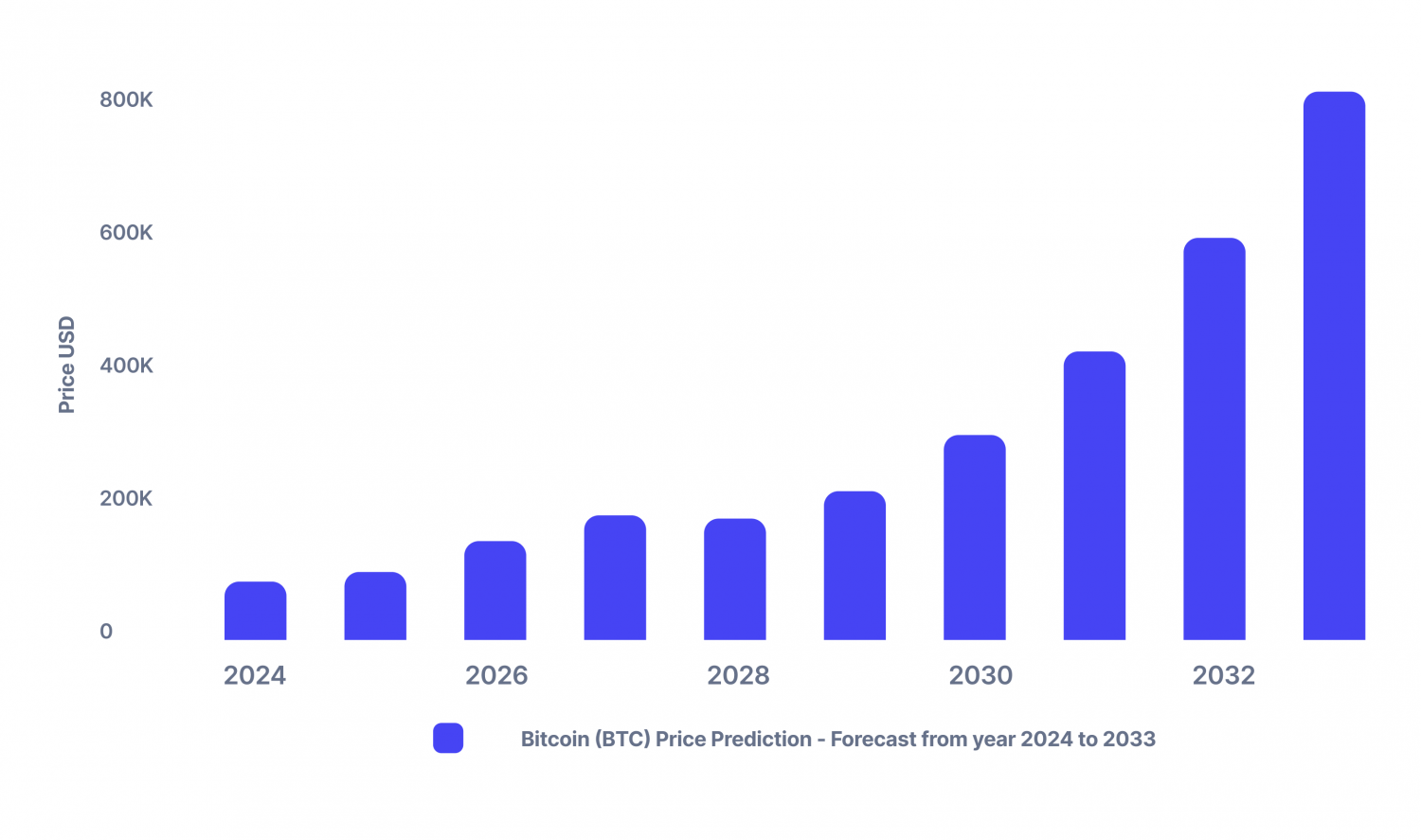

3.3 Expert and Investor Market Predictions

Given Bitcoin’s unpredictability, expert opinions on its future price are highly varied. Some predict Bitcoin will continue to rise, while others believe it will face a long-term decline.

Bullish Predictions: Optimism for Bitcoin’s Future

Many optimistic experts believe that Bitcoin’s price will eventually reach new all-time highs. For instance, PlanB, a well-known cryptocurrency analyst, has made several predictions about Bitcoin reaching $100,000 or more per Bitcoin in the next few years, driven by continued adoption and institutional investment.

Additionally, Bitcoin’s fixed supply (21 million) is often cited as a key factor in its inflation resistance, which many believe will drive the price higher in the long term.

Bearish Predictions: Caution in the Market

On the other hand, some analysts are cautious, citing factors like Bitcoin’s volatility, lack of regulation, and market manipulation as reasons why its price could stagnate or decline. Peter Schiff, a prominent economist and Bitcoin skeptic, frequently argues that Bitcoin is not a store of value and that it will eventually be replaced by other more efficient technologies.

Short-Term vs Long-Term Views

Experts also have varying opinions on short-term vs long-term forecasts. In the short-term, Bitcoin’s price may fluctuate widely due to market sentiment, regulations, and macroeconomic factors. However, long-term investors often take a buy-and-hold approach, betting on Bitcoin’s value preservation and adoption in the future.

| Expert | Prediction | Timeframe | Rationale |

|---|---|---|---|

| PlanB | $100,000+ | 2-5 years | Limited supply, increasing adoption, inflation resistance |

| Peter Schiff | $10,000 (or lower) | 1-3 years | Bitcoin is speculative, lacks intrinsic value, risks regulation |

| Cathie Wood (ARK Invest) | $500,000+ | 5-10 years | Bitcoin as digital gold, increasing institutional investment |

Reasons Why Bitcoin Goes Up and Down in Value:Making Investment Decisions Based on Bitcoin’s Price Volatility

Bitcoin’s price volatility presents both challenges and opportunities for investors. Its rapid fluctuations can create significant gains but also lead to substantial losses. This chapter will explore how to navigate Bitcoin’s volatility by examining investment strategies, risk management techniques, and the role of market psychology in decision-making.

4.1 Short-Term Trading vs Long-Term Holding Strategies

Investing in Bitcoin can be approached in two primary ways: through short-term trading or long-term holding. Each strategy carries its own set of advantages, risks, and time commitments.

Short-Term Trading Strategies: Day Trading and Swing Trading

Short-term traders seek to capitalize on Bitcoin’s price volatility within short time frames, often hours, days, or weeks. These traders rely on technical indicators, market sentiment, and news to make rapid decisions. Two common short-term strategies include:

- Day Trading: Day traders buy and sell Bitcoin within a single trading day, aiming to profit from small price movements. This strategy requires constant market monitoring and can be mentally taxing. Day traders often use tools like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) to determine the best times to buy or sell.

- Swing Trading: Swing traders hold their positions for several days or weeks, capitalizing on medium-term price swings. This strategy requires a good understanding of market cycles and trends, often using chart patterns to predict price movements.

Risks of Short-Term Trading:

- Emotional stress due to rapid market fluctuations.

- Increased likelihood of making impulsive decisions during periods of high volatility.

- Transaction costs, especially when trading frequently, can erode profits.

Long-Term Holding Strategies: Dollar-Cost Averaging (DCA)

Long-term investors adopt a more patient approach, aiming to hold Bitcoin for several years or even decades. These investors believe in Bitcoin’s potential as a store of value and often ignore short-term market noise.

One popular long-term strategy is Dollar-Cost Averaging (DCA), which involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price. This strategy reduces the impact of market timing and minimizes the risk of buying Bitcoin at a peak price.

- For example, an investor might decide to buy $500 worth of Bitcoin every month. If the price is low, they get more Bitcoin, and if the price is high, they get less. Over time, this strategy can help average out the cost of entry, potentially reducing the effects of market volatility.

Advantages of Long-Term Holding:

- Potential for substantial long-term gains, as Bitcoin has historically appreciated in value over extended periods.

- Reduced stress compared to short-term trading.

- Lower transaction costs due to infrequent buying or selling.

Risks of Long-Term Holding:

- The risk of price declines over an extended period, especially during prolonged bear markets.

- Missing out on potential profits from short-term price fluctuations.

4.2 Risk Management and Portfolio Diversification

Due to Bitcoin’s volatility, managing risk is crucial for any investor. Whether you’re a short-term trader or a long-term holder, protecting your capital and mitigating potential losses is a key part of successful investing.

Risk Management Techniques

- Stop-Loss Orders: A stop-loss order is a tool that automatically sells Bitcoin if its price falls to a predetermined level. This can help limit losses during periods of rapid price declines. For example, if you purchase Bitcoin at $30,000, you might set a stop-loss at $25,000 to prevent larger losses.

- Take-Profit Orders: Similarly, a take-profit order automatically sells your Bitcoin when it reaches a desired price. For instance, if Bitcoin’s price rises to $35,000, you can set a take-profit order to sell, locking in profits before any potential price decline.

- Position Sizing: Position sizing refers to determining how much of your total capital should be invested in Bitcoin. For example, an investor might decide to only allocate 5% of their portfolio to Bitcoin, ensuring that a single large loss does not significantly damage their overall portfolio.

Portfolio Diversification

Another important technique for reducing risk is portfolio diversification. Bitcoin is a highly speculative asset, so pairing it with other types of investments can help balance the overall risk.

- Stocks and Bonds: Pairing Bitcoin with traditional assets like stocks and bonds can provide stability, as the performance of these assets does not necessarily correlate with Bitcoin’s movements.

- Other Cryptocurrencies: Some investors choose to diversify within the cryptocurrency space by holding a mix of Bitcoin and altcoins (such as Ethereum, Litecoin, or Cardano). However, it’s important to note that altcoins also tend to be volatile, so they do not provide complete protection against risk.

- Commodities or Real Estate: For more diversification and stability, investors might consider including assets like gold, real estate, or even commodity ETFs in their portfolios. These tend to move independently of Bitcoin and can offer more stable returns.

By balancing Bitcoin with more traditional or non-correlated assets, investors can reduce the overall risk in their portfolios and better weather periods of extreme volatility.

4.3 Market Psychology and Emotional Control

The psychology of market participants plays a significant role in Bitcoin’s volatility. Fear and greed are powerful emotions that often lead to irrational decision-making, particularly in the context of Bitcoin, where price swings can be extreme.

Staying Calm During Market Fluctuations

To make more rational decisions, investors need to manage their emotions effectively. Here are some strategies to stay calm during periods of high volatility:

- Stick to a Plan: Whether you are trading short-term or holding long-term, having a clear investment plan can help prevent emotional decisions. Determine in advance how much capital you’re willing to invest, and decide when to take profits or cut losses.

- Avoid Herd Mentality: Bitcoin’s price can be highly influenced by FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt). When everyone is buying or selling, it’s easy to follow the crowd. However, this can lead to buying at the peak or selling at the bottom. It’s crucial to base decisions on your strategy, not on market hype.

- Understand Market Sentiment: Bitcoin’s price is heavily influenced by market sentiment, which can be driven by news, social media, and public opinion. By understanding whether the market is in a state of extreme optimism or extreme pessimism, you can better gauge the likely direction of prices.

- Take Breaks: If you’re feeling overwhelmed by price fluctuations, it can be helpful to take a break from monitoring the market. Constantly checking Bitcoin’s price can cause unnecessary stress and lead to emotional decisions.

Investor Behavior and Market Sentiment

Understanding the psychological behavior of other investors is also essential. Market sentiment often follows cycles of optimism and fear, leading to price bubbles and crashes. By understanding these cycles, investors can make more informed decisions and avoid falling victim to market manipulation or panic-selling.

Frequently Asked Questions (FAQ)

In this chapter, we’ll answer some of the most common questions about Bitcoin’s price volatility and help you understand the key factors that influence its price movements. Given Bitcoin’s unpredictable nature, it’s essential to address these questions to make informed investment decisions.

Q1: Why Bitcoin Goes Up and Down in Value frequently?

Answer:

Bitcoin’s price is highly volatile due to several factors:

- Demand and Supply: Bitcoin has a fixed supply (21 million coins), and its price can fluctuate significantly based on changes in demand. When demand increases, the price tends to rise, and when demand drops, the price falls.

- Market Sentiment: Bitcoin’s price is significantly affected by market emotions, such as FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt). These psychological factors can lead to rapid price swings.

- Regulatory Policies: Government regulations and decisions, such as ban announcements or approval of Bitcoin ETFs, can create abrupt price changes. The lack of clear regulation makes Bitcoin susceptible to sudden market movements.

- Macroeconomic Conditions: Bitcoin’s price can also react to broader economic factors, such as inflation rates, currency devaluation, or economic crises. In times of economic instability, some investors flock to Bitcoin as a store of value, driving up the price.

- Technological Developments: Updates to Bitcoin’s blockchain or new innovations within the cryptocurrency space can also influence its price. For instance, positive developments like Lightning Network adoption could drive prices upward.

Q2: What are the main factors driving Bitcoin’s price fluctuations?

Answer:

Several key factors drive Bitcoin’s price changes:

- Demand and Supply: Bitcoin’s limited supply combined with growing interest in digital currencies causes price fluctuations. When demand outpaces supply, prices rise, and vice versa.

- Market Sentiment: Investor emotions, such as fear or greed, play a huge role in Bitcoin’s volatility. FOMO can lead to rapid price increases, while FUD can cause sharp declines.

- Regulatory Policies: Government decisions regarding the legality or regulation of Bitcoin can result in immediate price movements. Announcements from countries like China or the United States about their stance on Bitcoin often cause massive market reactions.

- Global Economic Conditions: Bitcoin is increasingly seen as a hedge against inflation and currency devaluation, particularly in times of economic turmoil. Bitcoin often rises in value during inflationary periods when traditional currencies weaken.

- Technological Developments: Bitcoin’s price can be impacted by changes in technology that affect its usability, scalability, or security. Innovations or vulnerabilities discovered within its code can create rapid price movements.

Q3: Will Bitcoin’s price keep going up forever?

Answer:

Not necessarily. While Bitcoin has experienced substantial growth over the years, its price is highly volatile and unpredictable. Future price movements will depend on various factors, including:

- Technological Advancements: The development of Bitcoin’s underlying technology could either enhance its value or expose it to new risks.

- Market Sentiment: Periods of heightened optimism can lead to price increases, while fear or negative news can cause price declines.

- Regulatory Changes: If governments impose stricter regulations or ban Bitcoin altogether, it could negatively impact its price.

- Competition from Other Cryptocurrencies: The rise of competing cryptocurrencies or technological platforms could challenge Bitcoin’s dominance in the market.

Thus, while Bitcoin may continue to appreciate over the long term, short-term price movements remain highly volatile, and there is no guarantee that its price will keep rising indefinitely.

Q4: Is there a “fair” price for Bitcoin?

Answer:

There is no definitive “fair” price for Bitcoin, as it is not tied to earnings, dividends, or physical assets like traditional investments such as stocks or real estate. Bitcoin’s price is primarily driven by:

- Demand and Supply: Bitcoin’s price fluctuates based on how many people are buying versus selling. Its fixed supply (21 million coins) and varying demand create volatility.

- Investor Sentiment: Investor perception and confidence in Bitcoin’s long-term potential are central to its price movements. The market often overreacts to both positive and negative news, further influencing the price.

- Speculation: A large part of Bitcoin’s price is driven by speculative activity. Investors often buy and sell based on market trends and predictions, rather than intrinsic value.

Because Bitcoin’s price is largely speculative, determining its “fair” price is subjective and depends on the individual investor’s outlook.

Q5: How can I mitigate the risk of Bitcoin’s price volatility?

Answer:

Investors can manage the risk of Bitcoin’s volatility using the following strategies:

- Diversification: One of the most effective ways to manage risk is to diversify your portfolio. Don’t put all your funds into Bitcoin. Consider including traditional assets (stocks, bonds, etc.) or other cryptocurrencies to reduce overall risk.

- Dollar-Cost Averaging (DCA): With DCA, you invest a fixed amount in Bitcoin at regular intervals, regardless of its price. This strategy helps smooth out the effects of short-term volatility and reduces the impact of market timing.

- Risk Management Tools:

- Stop-Loss Orders: Set a price point at which Bitcoin will automatically be sold if its value falls below a certain level. This helps protect against major losses during rapid price drops.

- Take-Profit Orders: Set a target price where Bitcoin will be sold once it reaches a certain value. This locks in profits before a potential reversal.

- Avoid Emotional Decision-Making: The volatility of Bitcoin can lead to impulsive decisions driven by fear or greed. Developing a disciplined approach and sticking to a well-defined investment strategy can help mitigate emotional trading.

- Understand Market Cycles: By understanding Bitcoin’s historical market cycles (bull markets, bear markets, and corrections), investors can make better-informed decisions about when to enter or exit the market.

Q6: What does Bitcoin’s future price movement look like?

Answer:

The future of Bitcoin’s price is uncertain, and its movements will depend on several key factors:

- Technological Development: Continued progress in the scalability and security of Bitcoin’s network could increase its adoption, leading to higher prices. The implementation of solutions like the Lightning Network could improve transaction speed and lower costs, increasing Bitcoin’s appeal.

- Global Economic Conditions: In times of inflation or financial instability, Bitcoin could be viewed as a safe haven asset. On the other hand, changes in interest rates or economic recovery could dampen demand for speculative assets like Bitcoin.

- Regulatory Developments: The future of Bitcoin depends heavily on how governments regulate the cryptocurrency. If countries adopt favorable policies or create clear legal frameworks, Bitcoin could see significant growth. However, if governments impose bans or restrictive regulations, Bitcoin’s price could suffer.

- Market Sentiment: As Bitcoin becomes more widely adopted, the broader market sentiment surrounding it will play a large role in determining its future price. The more mainstream Bitcoin becomes, the more stable its price could become over time.

In conclusion, Bitcoin’s future price movements remain highly uncertain, and investors must be prepared for both ups and downs as external factors, such as technological changes, economic conditions, and regulatory policies, will continue to influence its value.